Staying Safe Online – is it as easy as we think it is?

Posted: 5 February 2019 at 11:10 am | Author: Lauren Daws

The internet and digital technology has become a massive part of our lives, but it’s important to know how to stay safe when using it. Safer Internet Day is all about highlighting how we can work together to create a safer online environment. Take a look below for some tips on how you can stay safe online.

How much time do we really spend on the internet?

While the internet and many social media channels aim to connect users, could they be doing the opposite? Next time you find yourself aimlessly scrolling through your Facebook feed, think about what you could be doing instead that might be more valuable to you. Speak to your family/friends about how their day was, read a book or even take up a new hobby!

Click here to see just how much happens on the internet in 60 seconds..

What impact would a cashless society have on young people?

With more and more aspects of our lives becoming digitalised, it’s only a matter of time before cash becomes a thing of the past. It’s predicted that by 2026, cash will be used for just 21% of payments, in comparison to 62% in 2006. For many people, this is a good thing – there’s no need to worry if you forget your wallet, thanks to Apple Pay/Android Pay, all you need is your phone.

However, could this be impacting young people’s ideas of the value of money? I’m sure we’ve all heard of at least one instance where a young person has unintentionally spent real money while playing mobile apps. In-app purchases and the increased use of credit/debit cards and contactless payments are raising concerns that people are failing to understand the real value of money. Seeing money be spent with the swipe of a card, or even a phone, is causing parents and others to worry that young people are beginning to believe that money is instantly accessible.

However, could this be impacting young people’s ideas of the value of money? I’m sure we’ve all heard of at least one instance where a young person has unintentionally spent real money while playing mobile apps. In-app purchases and the increased use of credit/debit cards and contactless payments are raising concerns that people are failing to understand the real value of money. Seeing money be spent with the swipe of a card, or even a phone, is causing parents and others to worry that young people are beginning to believe that money is instantly accessible.

How can you stay safe when banking online?

Although banks take all the steps they can to ensure online banking is as safe and secure as it can be, there are also some precautions you can take when banking online to make sure your personal information doesn’t fall into the wrong hands:

- Don’t give your PIN or any passwords out even if the email/phone call sounds like it’s from your bank – they would never ask for this information.

- Type your bank’s website address into a search engine rather than clicking on links in any emails as this could expose you to a phishing attack.

- Don’t log onto your online banking account if connected to a public Wi-Fi. Doing so can allow cyber-criminals to intercept your personal information as you enter it into the app or website.

For more tips on how to stay safe when banking online, click here.

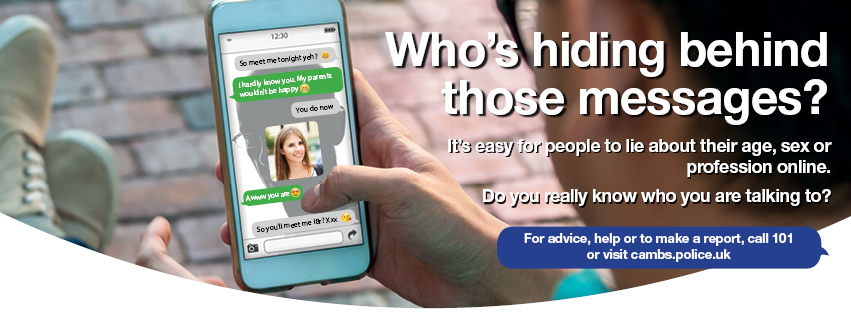

Are they who you think they are?

Using someone else’s pictures and creating a fake profile is easier than some may think, which is why you should take extra precautions when speaking to someone online.

Younger people are particularly vulnerable to trusting those they meet online, and although having a conversation with someone you met on a social media app may seem harmless, it can have real life consequences. If you believe this person to be who they say they are it can become easy for them to encourage you to share personal details with them, such as your phone number, where you live, work or go to school etc. This can be dangerous should the information fall into the wrong hands, which is why it’s important to remember:

Younger people are particularly vulnerable to trusting those they meet online, and although having a conversation with someone you met on a social media app may seem harmless, it can have real life consequences. If you believe this person to be who they say they are it can become easy for them to encourage you to share personal details with them, such as your phone number, where you live, work or go to school etc. This can be dangerous should the information fall into the wrong hands, which is why it’s important to remember:

- Not to share any personal information online

- Make your social media profiles private/change the security settings to private if you don’t want people you don’t know to have access to your profile.

- Check videos/images before posting as these can sometimes reveal information about your location. Also be sure not to ‘tag’ your location if you have followers/friends who you don’t know personally or if your profile is public.

- Sharing sexually explicit content involving someone under the age of 18 is illegal – even if the person in question is a friend.